An analysis of the global electric vehicle market and tech trends shaping the future of EV landscape.

Introduction

According to Frost & Sullivan’s Global Electric Vehicle Market Outlook 2018, global sales of electric vehicles (EVs) will climb from 1.2 million in 2017 to 2 million in 2019. With more than 6 years of experience in the automotive industry, we at Bamboo Apps believe that EVs have the potential to disrupt the automotive market while paving the way for increased energy security and eco-friendly, low-emission future. Read on to find out how the EV landscape will evolve over the next years.

EV Market Outlook

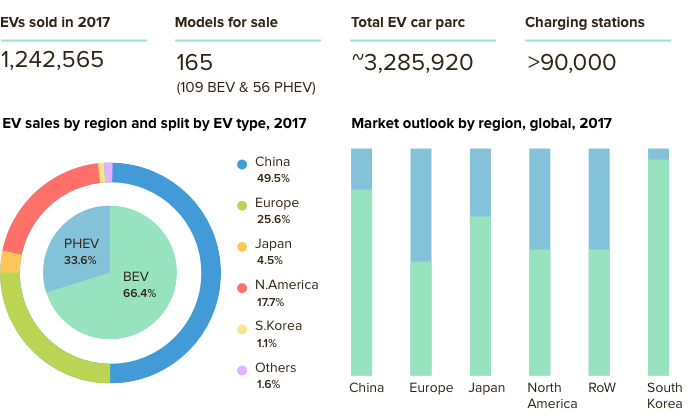

In 2017, the electric vehicle market reached the 1.2-million sales mark for the first time, with more than 165 models available for sale. The global electric car stock surpassed 3.2 million units in 2017 after crossing the 2 million vehicle threshold in 2016. Based on the OEMs’ announcements, EVs now have a market potential of about 25 million units that will be sold by 2025; more than 400 models will be made available.

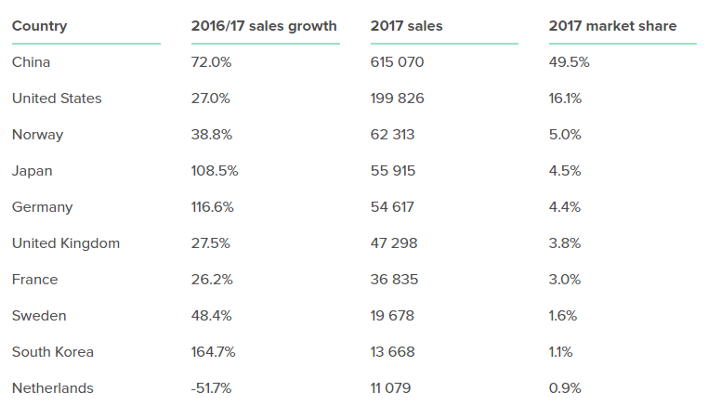

China surpassed the United States in 2016 in total electric car stock, becoming the country with the most EVs on its road network. China and the United States make up 65% of the global electric car stock. European countries, combined, account for most of the rest, representing 25,6% of the global total. Like electric car sales, the global stock is still concentrated in a few markets. The top five countries account for 80% of the total, while the top ten countries account for 96%. Battery electric vehicles (BEVs) still hold the fort, meanwhile BEV domination comes from China supported by the government.

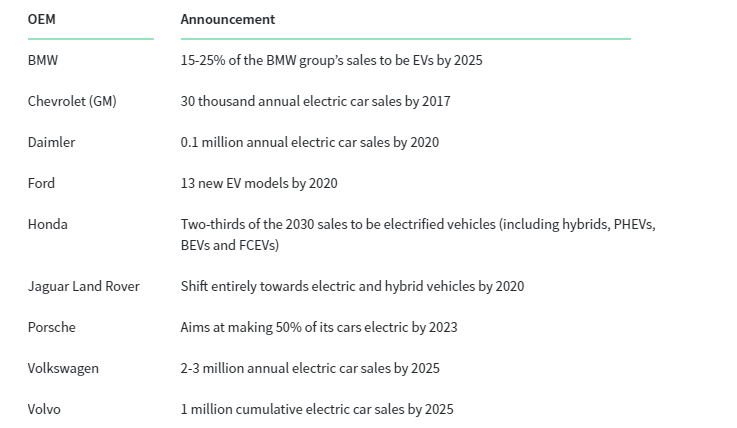

The year 2017 also recorded important announcements on electric car deployment targets from major global OEMs.

As we see from Table 2, last year was marked by a flurry of announcements from major automakers about their plans for the EV market. Accounting for the global OEM ambitions, the stock of electric cars has a mouthwatering potential of 400 models and estimated global sales of 25 million by 2025.

Views on EV Adoption

What’s driving the global EV industry? Business opportunities in eco-friendly mobility, increased government supportive policy, reduced costs and battery advancements are paving the path for mass-scale production and foreseen demand of EVs in the coming years. In various research and forecasts, the industry experts underly five factors to drive increased EV adoption by 2025:

- Policy support in key markets like the US, Europe, and China;

- EVs become competitively priced;

- Falling battery price;

- Development of EV charging infrastructure;

- The growing role of intelligent mobility: car sharing, ride-hailing, and autonomous driving.

Policy support in key markets

A supportive policy environment enables market growth by making vehicles appealing to consumers and encouraging OEMs. Policy support mechanisms include support for the research and development of innovative technologies; targets, mandates and regulations; financial incentives; and other instruments (rebates or tax credits on EVs, discounted tolls and parking fares etc.). Public procurement is also well suited to facilitating EV uptake. Moreover, several cities have already added EVs to municipal fleets and public transportation.

EVs become competitively priced

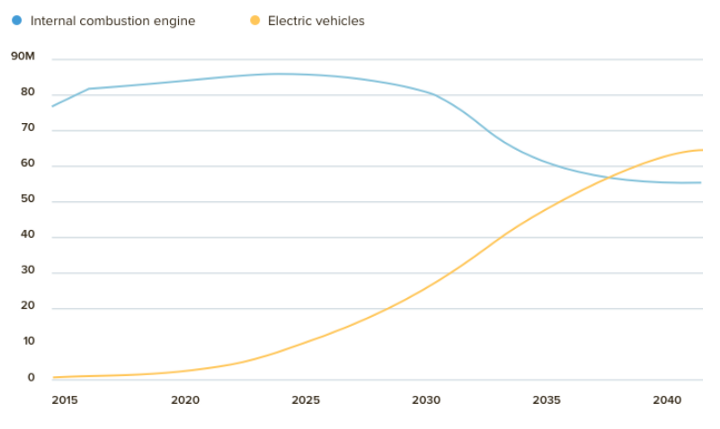

‘The Bloomberg New Energy Finance’ forecast says adoption of emission-free vehicles will happen more quickly because the cost of building electric vehicles is falling fast. Authors of the forecast make a conclusion that electric vehicles will become price competitive on an unsubsidized basis beginning in 2025. By 2038 electric vehicle sales will surpass internal combustion engine (ICE) sales.

“Electric cars are intrinsically cheaper than gas or oil fuelled cars because they’re simpler and their maintenance is a lot easier”

Francesco Starace, CEO of Enel SpA

In just eight years, electric cars will be as cheap as gasoline vehicles, pushing the global fleet to 530 million vehicles by 2040.

Initiatives to develop low-cost, fast charging battery technologies that support long range have led to promising results. In 2017, car manufacturers targeted higher battery capacities of over 60 kWh that increased the range of an EV up to 250 on a single charge.

Increasing the pack size from 60 kWh to 100 kWh (roughly reflecting, in the case of an average EV sold in the US) will cause the increase in range from 200 km to 320 km and would also lead to a 17% reduction in cost per kWh at the pack level (Howell, 2017).

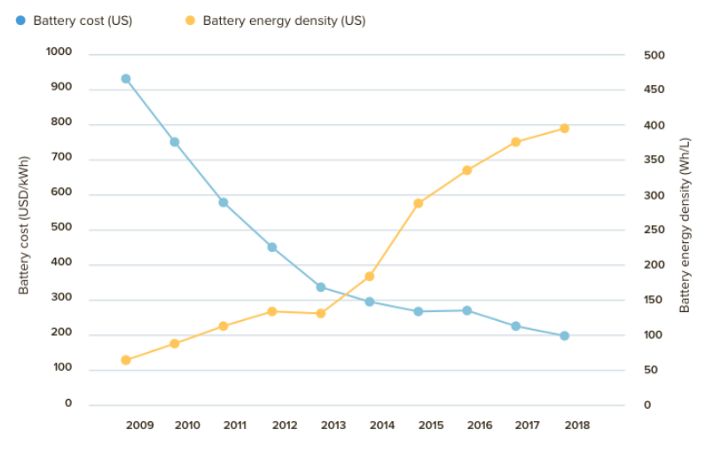

At the same time, the cost of lithium-ion batteries has already fallen by 73 percent since 2010. Battery costs are not just coming down in absolute terms, but in the near term battery costs may be less than half the cost of an EV. Prices fell below $200/KWH for a battery pack. Frost & Sullivan research indicates that this will push sales of luxury EVs as falling battery costs will help luxury EVs achieve overall cost parity with their fossil fuel-powered internal combustion engine (ICE) counterparts.

Development of EV charging infrastructure

The EV charging infrastructure challenge has not yet been adequately addressed. The amount of public EV chargers has grown significantly in the last five years, but there is still a need for more charging stations.

The global EV charging infrastructure market is expected to reach USD 45.59 billion by 2025, according to a new report by Grand View Research, Inc. Governmental policy, across the globe, is aimed at encouraging the adoption of electric vehicles by introducing new EV charging infrastructure. With the adoption of EVs, several new services around charging infrastructure, such as build and maintenance, new battery swapping centers, expansion of battery production/assembly centers and battery recycling, will also appear.

The growing role of intelligent mobility

Car sharing schemes (Berlin, Nagasaki, Brabantstad, Amsterdam) are giving urban citizens first-hand experience with driving an EV, which can then be used to make informed decisions about EV purchasing. Also, car sharing and EVs allow the two to be a demonstrable solution for innovative mobility while lowering emissions, noise, and traffic.

The rapid growth of ride-hailing services such as Lyft, Uber, and Ride Austin creates a unique opportunity for vehicle electrification. In addition to environmental benefits, electric vehicles are also significantly cheaper to operate than gas/diesel vehicle. This can be attributed to savings in fuel and maintenance, which scale by how much the vehicle is driven. Based on calculations made by Rocky Mountain Institute, a full-time taxi driver working 50 hours a week can save an average of $5,200 per year in total vehicle expenses with an EV as compared to a typical gas vehicle.

The Bloomberg New Energy Finance forecast says that autonomous vehicles will begin to replace existing human-driven cars starting in 2030. 80% of all autonomous vehicles in shared applications are expected to be electric by 2040 due to lower operating costs.

Conclusion

With the predicted rise of EVs — increasingly affordable, road-trip-worthy, and even cool — with major plans for the EV market and enormous driving force for the global EV industry, the electric power industry is getting a foot in the door of the coveted transportation sector.

Change is already happening and we’re looking at a future where manufacturers are open about wanting to expand EVs range, appeal to more customers, markets and make EVs more affordable. Here at Bamboo Apps, we are making the world where smartphones and other consumer devices are integrated seamlessly into the driving experience, where car-to-user communication is boundless and where the vehicle and the carmaker behind it are trusted partners in the driver’s daily life.

About Bamboo Apps

Bamboo Apps has accumulated considerable expertise in design and software delivery for the OEMs. We assist our clients with infotainment, HMI, telematics solutions to be implemented in PHEVs and BEVs. To learn more in detail about our automotive projects just drop us a line.