Introduction

Connected vehicles are often described as the next big leap for the industry after electrification. But it comes with a paradox: surveys show that while half of drivers are ready to switch to cars with smarter features, frustration with these features is also on the rise. Some of them feel genuinely useful, while others come across as inconvenient, redundant, or solving problems drivers never had.

Thus, for OEM product managers, the real challenge is to distinguish features that truly enhance the driving experience from those that frustrate customers or add little value. Drivers’ preferences and “anti-features” differ from source to source and sometimes even contradict each other, yet specific trends still stand out.

We analysed industry and media reports to identify the key ones.

West to East: regional trends

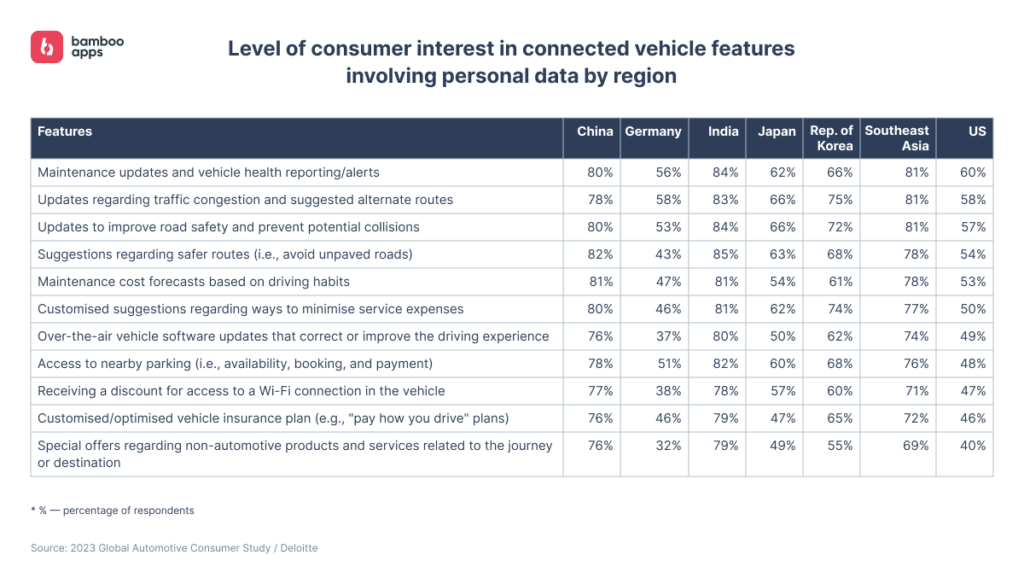

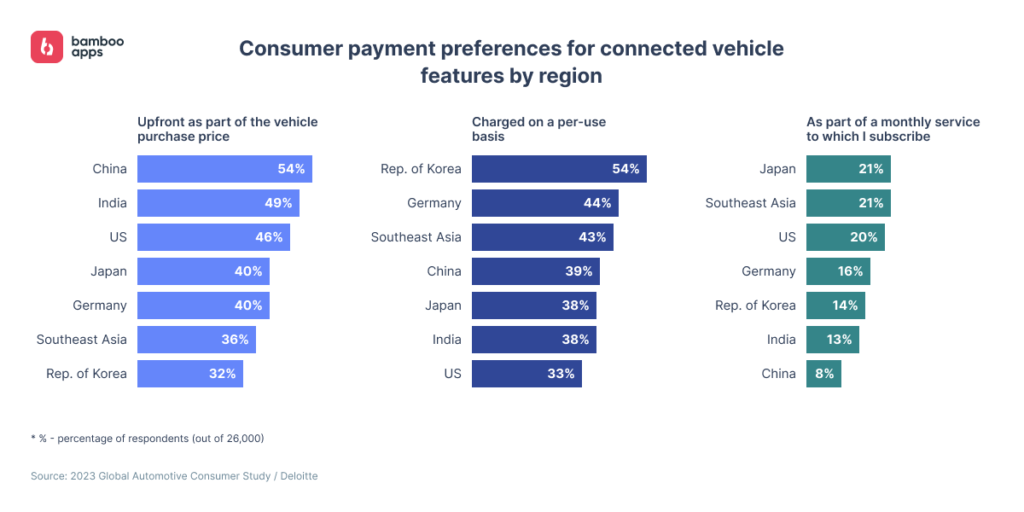

Drivers’ preferences vary by global region. In developed Western markets, especially the US and Germany, people are more cautious about connected features, Deloitte notes. Their main concerns are personal data and payment models, with subscriptions causing the most dissatisfaction.

Asian markets show much greater enthusiasm for new features. At the same time, drivers there are even less willing to pay by subscription, preferring one-off payments. This mix of excitement and reluctance toward ongoing payments is most evident in India and China.

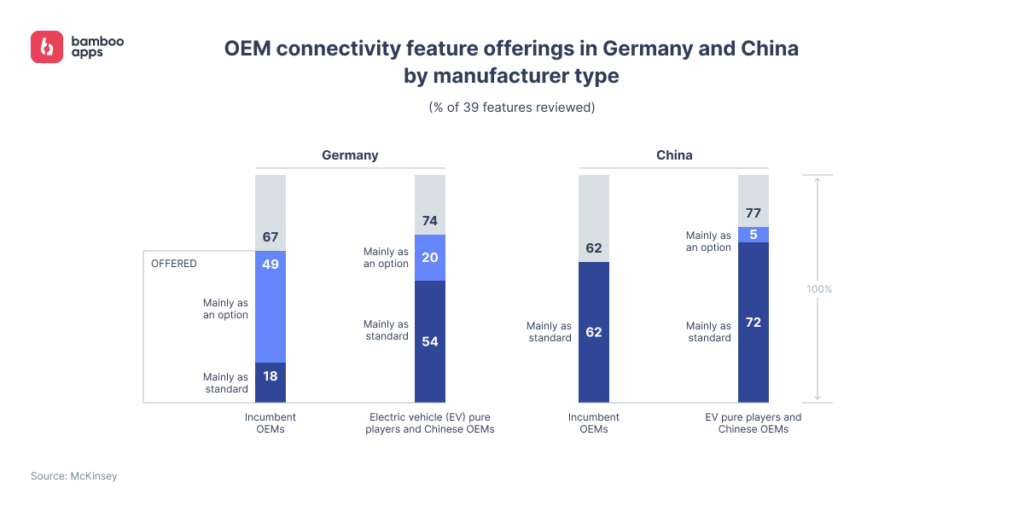

With demand high, Asia-Pacific OEMs, led by China, play a bigger role than Western OEMs in shaping the global features market, especially in electric vehicles.

Some global observations

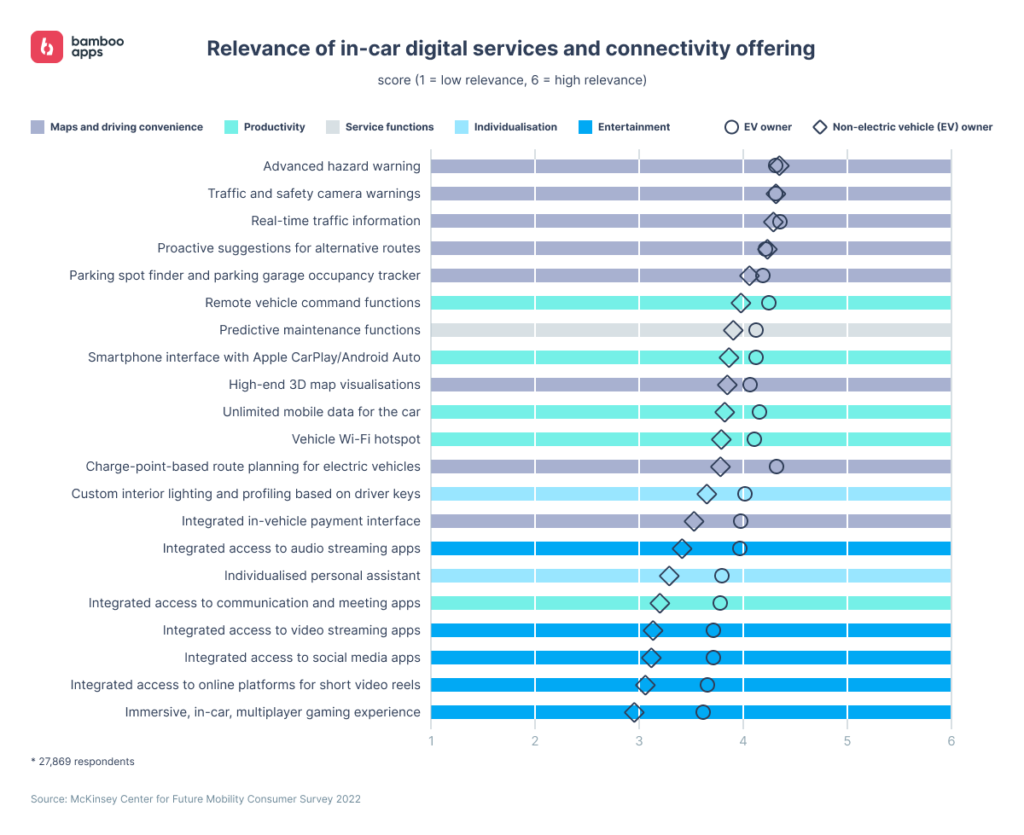

- EV owners show a greater interest in advanced connectivity and are more willing to share data for improved services.

- Drivers resist paying for features considered basic when competitors include them as standard (e.g. Apple CarPlay, integrated navigation system, or hands-free calls). The same applies to functions with built-in hardware or fragmented access, such as heated seats or full acceleration offered by subscription.

- Consumers, however, are generally more willing to pay for comprehensive safety features (e.g., Adaptive Cruise Control systems) than for convenience features like extended multimedia or ambient lighting packages.

- EV owners report more issues with connected features than drivers of internal combustion engine (ICE) vehicles.

- Many respondents cite a lack of information about connectivity features, which fuels scepticism.

Turn complexity into clarity

Help customers master connected features faster with the IVO interactive onboarding app

Features most drivers find useful

Smartphone integration (Apple CarPlay and Android Auto)

For many drivers, it’s a must-have option: nearly half of drivers wouldn’t buy a car without it. McKinsey reports that about 45% of drivers use Apple CarPlay and Android Auto regularly, and 85% prefer them to OEM systems, which they see as less convenient and flexible. Recent media reports confirm the trend.

At the same time, there is a growing demand for more reliable wireless smartphone integration.

ADAS: basic safety features

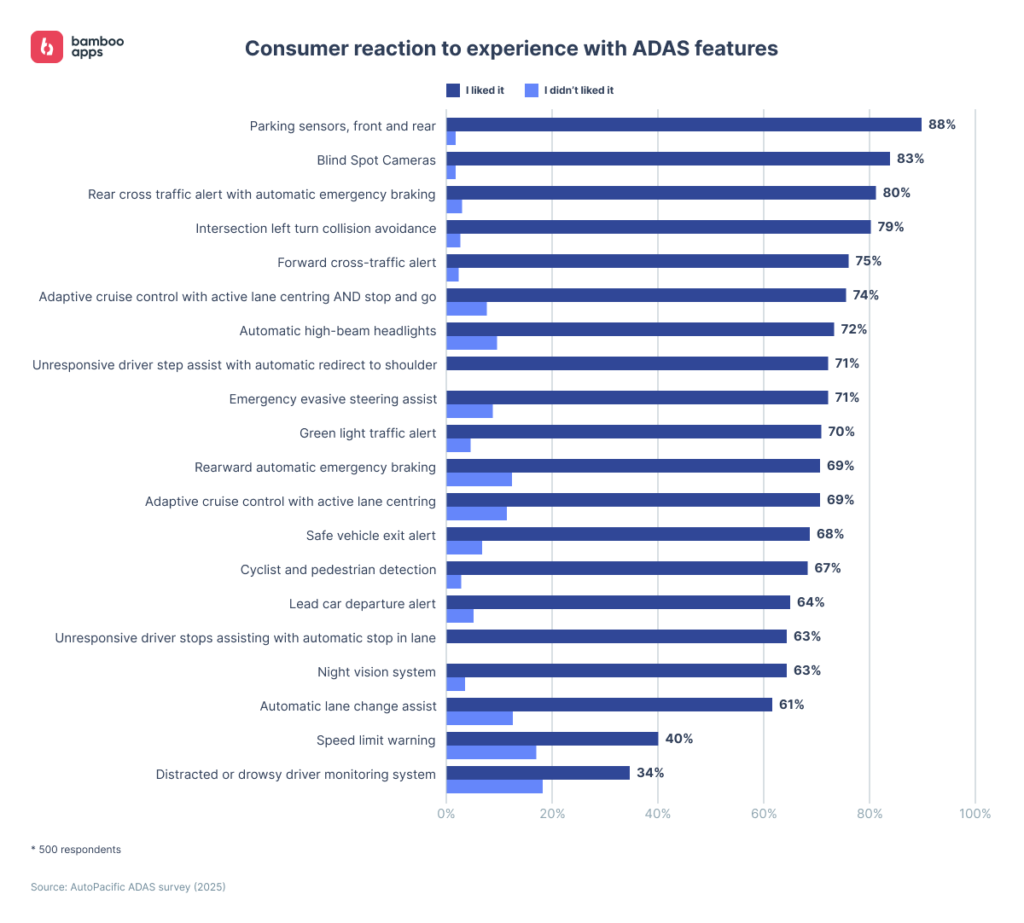

Simple, reliable safety functions consistently rank high in surveys. According to AutoPacific’s ADAS Survey, blind spot monitoring is the most popular safety feature.

Other widely valued functions include:

- forward and rear cross-traffic alerts;

- intersection collision prevention;

- adaptive cruise control with speed warning;

- automatic high beams;

- night vision systems, etc.

Among non-safety functions, parking assistance remains the most appreciated.

Overall, owners of electric and premium-class cars show a stronger interest in ADAS features, including advanced ones, than other drivers.

Predictive maintenance features

Alerts on vehicle condition and maintenance forecasts based on driving habits are among the most popular features in Deloitte’s survey. Despite privacy concerns, at least half of the respondents in the US and Germany are willing to share their data to access them. There is also demand for personalised insurance products based on this information.

Route alerts and navigation

While overall demand is higher in Eastern markets, Western drivers highly value on-route alerts, first of all:

- live updates on traffic jams and alternative routes (58% in both the US and Germany);

- updates to improve safety and prevent accidents (57% in the US; 53% in Germany);

- suggestions to avoid unsafe roads, including off-road areas (54% in the US; 43% in Germany).

Service search functions rank next, especially for EV drivers who need quick access to charging stations.

In-car payments

Drivers often criticise this option as slow, clumsy, and hard to use – yet 62% still want it. The function is most commonly used for fuel, parking, and tolls. Analysts expect its popularity to grow rapidly once payment tools become easier to use.

Simple AI control and personalisation

Surveys show that while the average driver is interested in AI features, they are seen as useful only when they are simple and solve a clear problem. That’s why features like smart seat memory, radio preferences, and predictive climate control resonate more strongly. They are convenient and improve year after year.

Unlimited or extended in-car internet access

The feature is helpful for most drivers, but EV owners value it more, placing it among the top eight in McKinsey surveys.

App-based remote vehicle control

Drivers value mobile apps that let them lock or unlock their car, check its health or location, and more. Such remote-control features are often included in “comfort & convenience” packages.

Explore our car connectivity project

See how Bamboo Apps completely rebuilt the InControl Remote app suite for Jaguar Land Rover

Features many drivers see as overrated

Infotainment systems

Infotainment systems continue to split opinions. Some surveys highlight their visual appeal and growing demand among EV drivers who spend time waiting to charge. For others, they are the weakest link –“do-everything boxes” filled with secondary functions drivers must scroll past to reach the essentials. Unstable connectivity, unresponsive touchscreens, and poor built-in navigation continue to push drivers toward services like Apple CarPlay.

On the other hand, a recent J.D. Power report noted the first signs of improved user experience from 2024, pointing to growth potential.

Biometrics and facial recognition

Fingerprints and facial scans still feel more like trendy gadgets, solving “non-existent problems” while creating new ones. 2025 surveys show that biometric authentication causes errors in about 29 out of 100 cars. Even more frustrating for drivers are face and eye-tracking technologies used in ADAS attention-monitoring features.

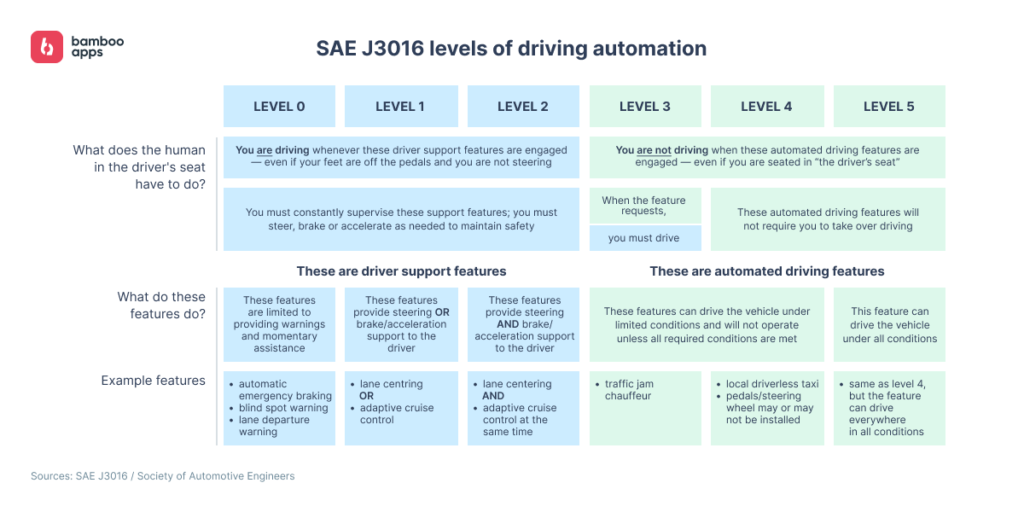

ADAS: bundled and complex semi-autonomous functions

While most safety features are valued, some are perceived as intrusive. Drivers often complain about lane-keeping assist – its steering corrections and constant prompts to keep both hands on the wheel. Collision warnings can also irritate drivers when they trigger too early or too often.

Problems also arise when manufacturers make features overly advanced or bundle them in packages, often with AI. As a result, drivers may confuse the functions, feel uncertain about when to rely on them, and report unpredictable behaviour.

Some of the most problematic features include:

- forward collision warning with automatic emergency braking;

- automatic lane changes;

- traffic sign recognition with speed adjustment (ISA);

- blind spot monitoring with active steering or braking, etc.

Higher-level autonomy (L2+), including hands-free functions, attracts interest but also concern after high-profile crashes. Users report loss of lane centring, sudden disengagements, and unclear takeover rules. In the EU, new regulations now require drivers to keep attention-monitoring systems active when using autonomous mode – a feature that, as we noted, remains unpopular.

OTA & remote upgrades

Sources give mixed reviews of these features. Drivers like the idea of getting new functions over the air, and analysts see strong revenue potential for OEMs. Yet J.D. Power’s 2025 Study found that only 36% of owners installed an update in the past three years – and only a third of them noticed any improvement. Complaints often centre on UI and performance issues, with some reports of Tesla EVs breaking down completely after updates.

Gesture controls and buttonless touch panels

“Futuristic” controls replacing traditional buttons also often irritate drivers. Gesture recognition features cause problems in almost half of the cases, while touch panels for audio and climate are hard to use by feel while driving. The previously mentioned smart climate control is valued because it removes the need to dig through touchscreen menus for basic settings.

Built-in voice functions and assistants

Users have mixed impressions of such functions. A YouGov survey shows that up to 42% are interested in voice assistants, while 34% are not. Interest is higher in voice control for simple functions, such as the radio or voice input for navigation. For more complex tasks and hands-off calls, drivers tend to prefer smartphone-based assistants, as built-in systems more often cause problems.

Car Wash Mode

The car-prep feature is called “brilliant but poorly executed.” It disables wipers and automatically closes windows, among other actions. Users are frustrated that it’s usually buried deep in the infotainment system, somewhere between glovebox and garage-door buttons. The function is also slow, and 38% of J.D. Power respondents reported needing more detailed instructions to use it.

Passenger extra displays

Some premium cars offer passenger screens and other extra displays, but many owners consider them unnecessary. They add cost and complicate the interface, while being rarely used.

Conclusion

Our analyses show: the success of connected car features depends less on technological novelty and more on how clearly they solve real driver problems. Functions that are simple, reliable, and intuitive create lasting value. Those that are intrusive, redundant, or poorly executed quickly lose relevance.

Thus, research points to several strategic takeaways for OEMs:

- Basic automated safety features are valued more than higher-level autonomy.

- Comprehensive safety features generate the strongest demand but also the lowest satisfaction.

- EV and premium drivers are more open to innovation and potential autonomy.

- Lack of awareness undermines the adoption of connected features.

- Regional differences require careful local adaptation.

- Buyers want flexible payment tied to clear feature value.

- Smartphones continue to outpace in-car tech, a gap unlikely to close soon.

In the years ahead, success will belong not to the brands with the longest feature lists, but to those that guarantee three essentials: uncompromising reliability of core functions, seamless ease of use, and transparent, customer-friendly payment models. All else is secondary.

Looking for a reliable partner to develop your connected vehicle solution? Find out more about Bamboo Apps’ expertise and schedule a consultation.