Modern automobiles are essentially becoming computers on wheels, and digital technology takes up to 50% of the development cost for new car models. The increased connected car and driver assistance functionality leads to the accelerated complexity for Original Equipment Manufacturers (OEMs), which have to manage the integration of hardware and software into vehicles.

At the same time, racing to react to fast-changing consumer demands with innovative solutions, OEMs have to shorten product life cycles. That is causing additional pressure for flexibility and innovation in both software product development and manufacturing processes.

Those factors contribute to the extensive use of different R&D outsourcing models, including staff augmentation and hiring dedicated expert teams. That allows automotive businesses to release internal resources while forcing them to expand the search for niche expertise.

To complicate matters, the industry challenges combine with the global shortage of technology talent. Reports by Gartner [1] and the Edge Foundation [2] predict that by 2020, the U.S. and the UK will experience a shortage of more than 1 million tech professionals.

The growing gap between supply and demand of expertise will make it nearly impossible to cover business needs only with the help of in-house teams. To stay ahead of the game, OEMs will have to quickly scale up their software development resources by bringing in dedicated experts provided by automotive outsourcing companies.

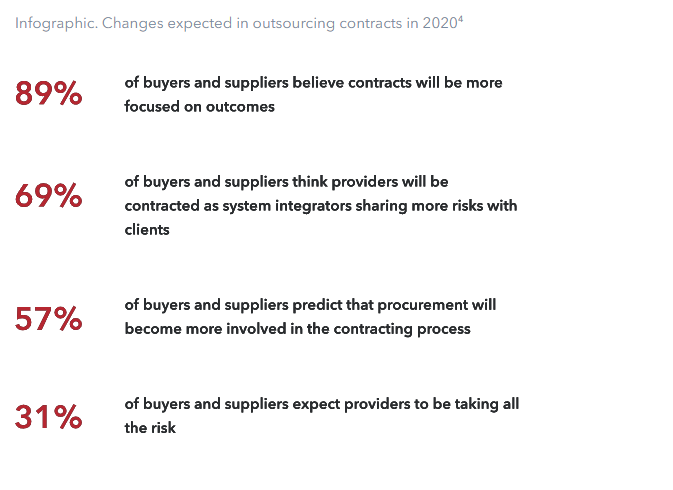

The new reality also impacts client-vendor relationships. Engineering Services Providers (ESPs) are expected to take on the role of system integrators and partners sharing governance duties and risks with clients. In this perspective, cost saving is no longer a main decisive factor for adding a vendor to an OEM’s ecosystem.

The spotlight moves to ESP’s ability to deliver additional value, and its careful evaluation becomes a new challenge for the executives who are to decide if a vendor will make or break the success of a project.

Written based on Bamboo Apps’ practical experience, this whitepaper provides C-Suite with a success model that allows for a seamless transition of an automotive software project to an external partner.

The Onset of Transition: Dealing with Challenges

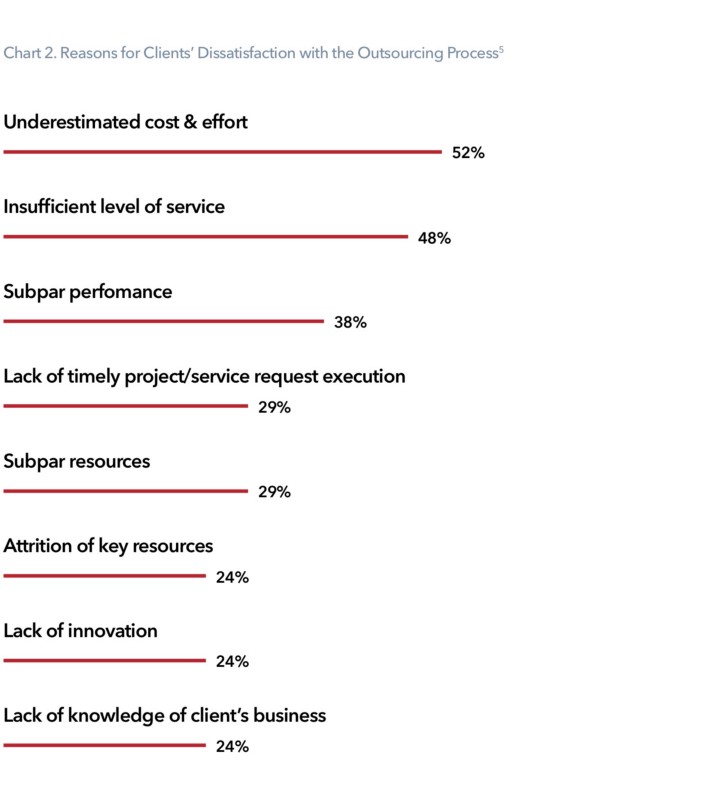

Despite the increase in the OEMs’ demand for outside tech talent, such collaborations are still generally notoriously difficult to manage. According to Deloitte research [3], about one-third of all the partnerships fail in the first year, while two-thirds of the executives report minor and major issues during the transition of projects to outside vendors.

Estimating chances for a successful outcome of the outsourced project is especially tricky because during the onset of the transition neither a buyer or a supplier anticipate future complications. At this stage a partnership is at its best – both parties have high expectations and their interests are in sync.

It’s only during the second phase when all the involved start to experience the full effect of the transition. Tension grows as the scope of a project and the complexity of the transition come into focus, and most of the established processes undergo stress-testing. Shortcomings in quality of service, data security measures, vendor’s expertise, transition flow, communication, and management become evident and overwhelming, leading OEMs to a fork in the road, where they should make a decision whether to continue or drop the collaboration.

No matter the choice, overall client experience and outcome will still suffer. Thus, to plan for a successful transition, define qualifiers for vendor’s entry to the selection list and parameters to differentiate the candidates on the early stages of the search, and then conduct a thorough analysis of potential partners.

Validating Expertise and Capacity of Automotive Outsourcing Companies

There are several aspects that can give helpful insights into vendor’s expertise and ability to deliver.

Contractor Type

Organization type may be the most obvious, but, nevertheless, one of the most often overlooked of the helpful clues. Essentially, the choice lies between large outsourcing companies and smaller service agencies. Although the first may attract OEMs with automated solutions and therefore reduced delivery time and costs, the quality of the final product can be hit or miss. Such vendors lack understanding of the industry-specific standards and practices and have not enough experience and highly-skilled talent.

That said, when it comes to outsourcing services, narrow specialization is a big advantage on the vendor’s scorecard.

Scalability of Experience

R&D projects vary significantly as do the skills required to complete them. In a particular moment of time, an OEM may be satisfied with a vendor having competences only in select development areas, but later this approach will prove to be less efficient. Having to manage multiple vendors is resource-consuming and may drain the budget quickly. Plus, it may cause a lack of flexibility when OEMs will have an emerging need for scaling their projects.

That said, having a trusted vendor with a scalable experience and skillset from the start has proved to be a more provident strategy. OEMs can outsource to such partners projects from the different ends of the complexity spectrum and be confident that they have expertise in all aspects.

“Experience makes for teams set up for success”

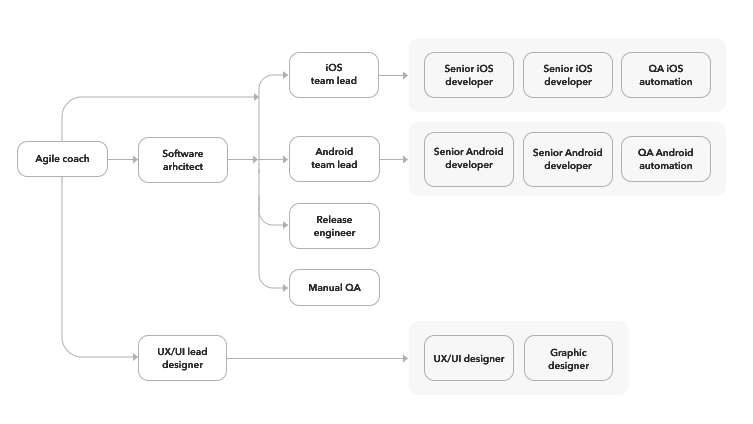

At Bamboo Apps, we prefer to develop team structures that can be easily and quickly applied to specific projects in advance. They’re based on our previous experience in delivering high quality and knowledge in R&D projects and can be easily scaled.

For example, for a large automotive project, Bamboo Apps created a team structure that included dedicated designers and Android/iOS developers, an agile coach with extensive expertise in the automotive sector, a product owner, a delivery manager, and architects.

For the Gentherm project, the same structure was scaled down to an agile manager, a product owner, and a UX/UI designer. In both cases, the chosen team structure helped to deliver unique value and meet the set targets.

Combination of Design & Technical Excellence

Seamless integration of delivered R&D projects will equally depend on the design and technical expertise of the team that will be working on an outsourced project. ESP’s portfolio should prove that their on-site team has a deep understanding of software and automotive hardware, sufficient knowledge of frameworks and restrictions, and mastery of testing and prototyping.

“Surround your company with those, who bring a new vision”

It’s really beneficial if the vendor’s team has a level of knowledge and skills similar to that of your on-site designers and developers, because not only will they be able to meet quality and innovation targets but also to outperform them.

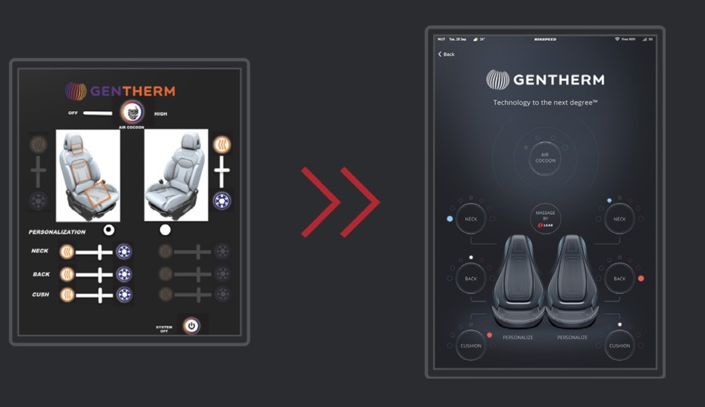

When Bamboo Apps started working on the Gentherm project, the client provided us with the mockups. After analyzing and testing them, Bamboo Apps’ team suggested some changes.

Implementation of the two-level logic significantly improved usability: top-level screen now allows for quick and easy access to the core functionality of the system, while detail screens let users customize the settings of a particular seat.

Bamboo Apps also enhanced the design: original slider bars were replaced with visuals that clearly indicated current settings of each element of a seat while controls were resized for touchscreen convenience. To ensure seamless integration of the final design concept with third-party hardware, our team also aligned it with LabVIEW guidelines and adapted it to technical restrictions. As a result, the innovative functionality of Gentherm’s seats was complemented by engaging intuitive design and optimized user experience.

Evaluating Operational Maturity and Stability

Vendor’s portfolio is a good clue to understanding their potential to meet quality level requirements, as well as their mastery of necessary technology and overall understanding of the industry-specific design trends. However, it lacks information about ESP’s ability to acknowledge the importance of the initiative in aligning expectations, establishing strong governance of the project that will benefit their own stability and quality of service and product they deliver.

So, what can imply ESP’s operational maturity that is extremely valuable in today’s context 4 where outsourcing contracts focus more on “how” instead of “what”?

Collaborations and Internal R&D Projects

ESP’s history of collaborations is like a real-life model of a potential partnership: it helps to track their complete journey from establishing cooperation processes to execution and delivery of the final product.

Completion of internal R&D projects also adds points to the vendor’s credibility, because the better quality of the service comes with a better understanding of client needs. And companies that have managed internal R&D projects with set timeline and deliverables demonstrate more accuracy in estimating effort, time, and resources for meeting set targets, as well as more initiative in co-management of processes and co-creation of the additional value, therefore becoming trusted advisors for OEMs.

“Strategic planning is king”

No collaborations are easy, especially when many external teams are brought together to work closely on pursuing technical excellence and innovation. Thus, for many companies balancing communication between multiple involved parties and staying on track with project timelines becomes an insurmountable obstacle.

Aware of this, we decided to plan ahead working on a futuristic HMI design for Rinspeed’s new concept vehicle. Several design concepts were created in advance, on a phase of choosing an ECU and HMI integration scheme. That way, Bamboo Apps was able to speed up the product approval process and ensure timely delivery.

Communication Strategy

Governance Structure

Vendors’ perception of their place in project governance structure should also be considered a deal-breaker when evaluating a shortlist of automotive outsourcing companies.

The supplier needs to be open to taking over a lion’s share of the project management. For example, ESP should offer their expertise in creating a team of best-suited project managers in both companies, distributing roles and responsibilities, and defining procedures of product delivery and approval.

“Think of management as a two-way street”

Consistent communication and a strong governance routine are critical for teams that are separated by distance and time zones. Our experience has proved that creating a governance team to monitor the relationship between the parties has a tremendous impact on the success of projects.

For example, such a team was created for Bamboo Apps’ ongoing partnership with Jaguar Land Rover. The governors from both sides have daily meetings to discuss the latest project status updates and have a quarterly business review meeting. The governance team also maintains the overall communication between the parties and monitors project schedules and budget. Plus, it works as a decision-making center for the escalation of topics that can’t be resolved within the project.

Other governance measures that help Bamboo Apps ensure the quality of delivered solutions and faster time to market are agile methodology set-up and agile coach on our side. Specifically, prioritization of backlog in collaboration with the client, defined procedures for new version uploads and flow approval.

We also recognize the importance of on-site working of both teams. That’s why our designers and developers frequently visit Jaguar’s office in the UK to participate in design and development workshops, demo and test sessions.

Conclusion

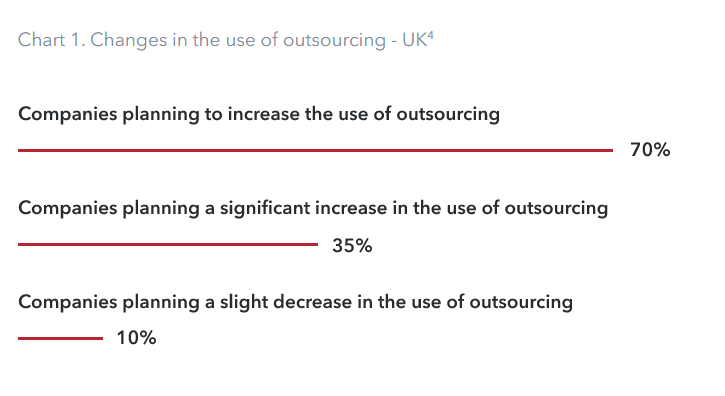

In the automotive industry, outsourcing has become a very promising initiative, and more and more engineering services providers will see an increase in demand for their expertise. More vendors will be trying to enter the market, which will create more opportunities as well as more difficulties for OEMs in finding a reliable partner for long-term collaboration on R&D projects.

Creating a model for predicting the success of an outsourced project, based on an assessment of vendor’s competencies, will ensure a positive experience and give executives a key to a technology advantage and ability to adjust to fast-changing customer demand and disruptive industry changes.