Why experience in automotive software matters

At major automotive industry forums, the conversation around vehicle software has become remarkably consistent.

At CES 2026, more than 30 OEMs, Tier-1 suppliers, and technology companies (including Volkswagen, BMW, Mercedes-Benz, Stellantis, and Infineon) expanded a joint open-source software initiative under the VDA. The goal is to reduce development and maintenance effort by up to 40% and accelerate time-to-market by around 30%. It seems software complexity can no longer be managed in isolation, and shared platforms only deliver value when participants bring proven, automotive-grade experience.

That shift makes sense. Bosch, for example, notes that modern software-defined vehicles already contain around 100 million lines of code (ten times as many as there were ten years ago), and advanced systems can reach several hundred million.

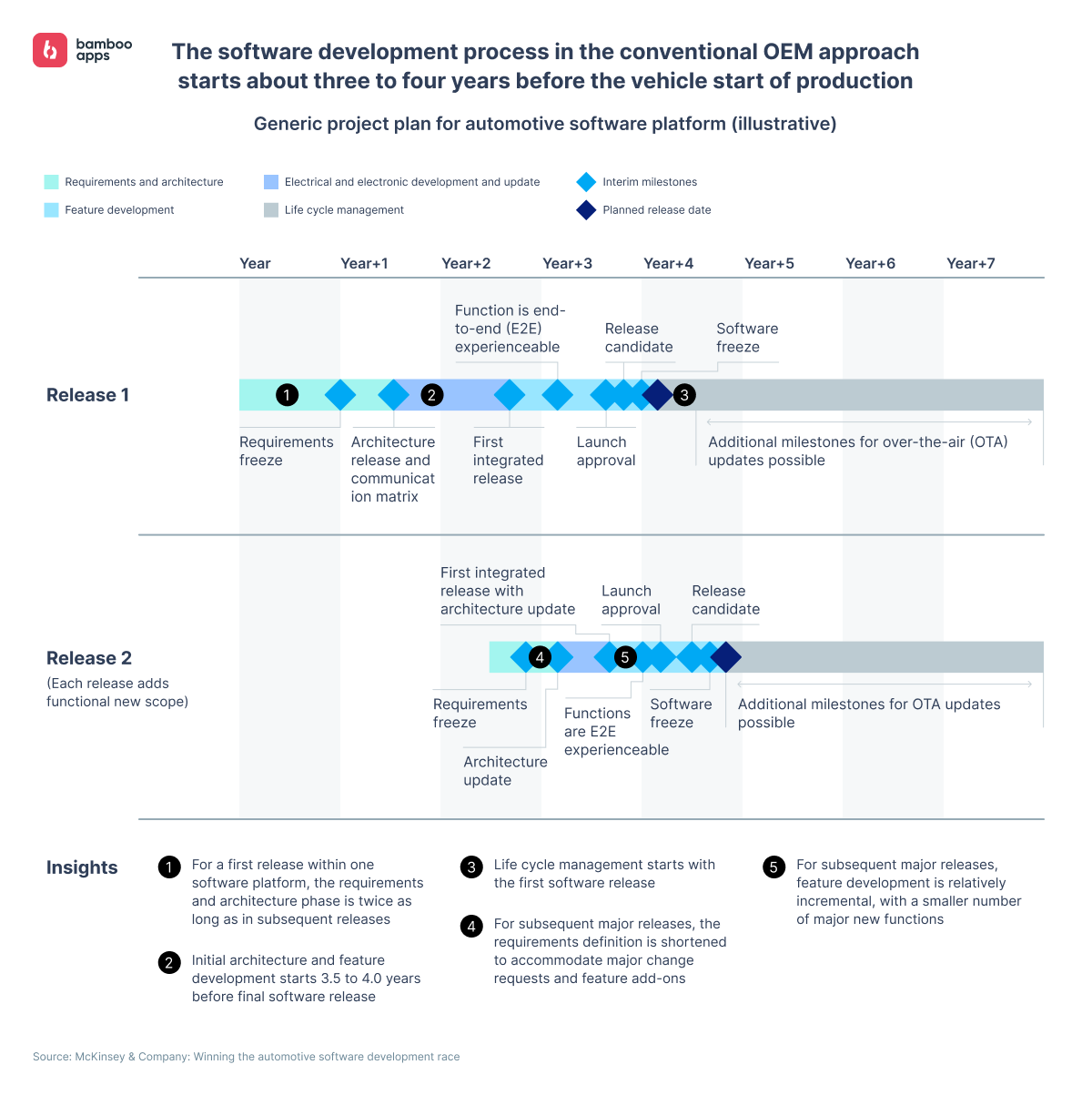

Besides, McKinsey points out that traditional OEM development cycles can still span 40–50 months, and one of the biggest challenges is coordinating work across teams, suppliers, and platforms throughout the full software lifecycle. Experience in navigating those cycles (and shortening them without increasing risk) matters far more than just isolated technical excellence.

Since software decisions now also shape brand value, customer loyalty, and warranty exposure in automotive, execution maturity may matter even more than novelty. And that is why choosing automotive software partners is one of the most important decisions to make.

Stefan Hartung, Chairman of the Mobility Solutions business sector at Bosch, believes that “the automotive and IT industries do not have to be competitors. More than ever, they will complement each other.” And that’s exactly the challenge: finding an automotive IT solutions partner who can complement you best.

Traits of top automobile software companies

Successful delivery of complex automotive software projects

When automotive leaders talk about successful delivery, they usually mean one thing: software that has made it into production and stayed there. Because pilots and demos are one thing, but delivering car software systems that run safely and sustainably in millions of cars is another.

During vendor assessment, case studies add a significant layer of confidence, especially when they focus on how complexity was handled rather than just the end result. Look for descriptions of integration challenges, validation phases, and the trade-offs made under safety, performance, or hardware constraints. The more specific the narrative, the more likely it reflects real delivery experience.

Testimonials, in this context, may give you named references and, just as importantly, the opportunity to speak directly with existing clients. That peer-to-peer conversation – hearing firsthand how a partner behaved under pressure, during integration, or close to SOP (Start of Production) – is one of the most reliable ways to assess whether a company can deliver complex automotive software in practice.

Press releases might also play a role here. What they do signal is the existence of a real, formal relationship. When an OEM or Tier-1 is willing to be publicly associated with a software partner, whether around a collaboration, a platform integration, or a product launch, it usually means that legal, compliance, and technical assessments are already behind them.

Find out how Bamboo Apps created a concept suite of connected car control apps and HMI design for Rinspeed’s new concept vehicle.

Integration experience with OEMs and suppliers

Integration is where many automotive software projects slow down because it has to fit into an ecosystem that already exists – with legacy systems, multiple Tier-1 suppliers, fixed architectures, and established development processes.

Teams that have worked in vehicle projects before tend to understand how responsibilities are split, how interfaces are negotiated, and how changes ripple across suppliers. They know that progress depends as much on alignment with other teams as on the quality of their own code.

A useful signal is how a company describes its integration work. Teams with hands-on OEM experience talk about dependencies and coordination instead of just features they delivered in isolation. That perspective reflects an understanding that, in automotive, software succeeds only when it fits cleanly into the broader vehicle architecture. This is particularly important in connected car platforms.

HMI expertise as a key differentiator

HMI (Human–Machine Interface) development stands out because it is one of the few areas where software quality is immediately visible to drivers and, by extension, to the brand. HMI performance is experienced every day.

However, automotive HMI is shaped by constraints that are easy to underestimate: limited hardware resources, safety and distraction requirements, and the need to remain stable across years of updates and vehicle models. Teams without automotive experience might often encounter these limits late, when design choices are already difficult to change.

HMI also reveals how well automobile software companies understand system-level trade-offs. Interface decisions affect boot times, memory usage, and interactions with embedded software and middleware layers. Companies that account for these dependencies early tend to avoid late rework and integration issues.

Read about Bamboo Apps’ experience with delivering a highly versatile HMI solution for hydrogen-powered commercial vans here.

This way, a software company that can deliver robust automotive HMIs is usually one that understands the broader vehicle context and is therefore a safer, more predictable partner when complexity and long-term reliability matter.

Safety and security standards applied

Safety and security standards are most valuable when they are applied in day-to-day delivery. Automotive SPICE (ASPICE) provides insight into how consistently a partner executes across requirements management, software development, integration, and validation, particularly in multi-supplier and multi-programme environments.

For safety-critical systems, the application of ISO 26262 is best assessed through evidence of real programme execution: completed HARA activities, ASIL allocation across system and software components, and safety mechanisms implemented and validated in production, especially in ADAS and automated driving contexts.

Similarly, effective application of ISO/SAE 21434 is reflected in how cybersecurity engineering is embedded into architecture decisions, development workflows, and post-SOP operations. Partners with production experience can demonstrate continuous threat analysis, vulnerability handling, and secure update processes rather than handling isolated compliance violations.

Testing and validation as part of automotive software services

For a mature partner, thorough testing and validation are standard parts of every project, not extra automotive software services. Bugs in production can have serious safety, operational, and reputational consequences, so robust practices are essential.

Testing covers multiple layers: from unit and integration tests on embedded systems to system-level validation on hardware-in-the-loop setups to in-vehicle application checks, including HMI and connectivity.

A partner that consistently applies these practices signals discipline, process maturity, and reliability. For decision-makers, it’s a clear indicator that the software delivered will be resilient and safe and that the company understands the complexity of automotive programmes from end to end.

Full‑stack engineering across embedded, cloud, and AI

Modern automotive industry software spans embedded systems, middleware, cloud platforms, in‑vehicle and mobile apps, and AI‑enabled features.

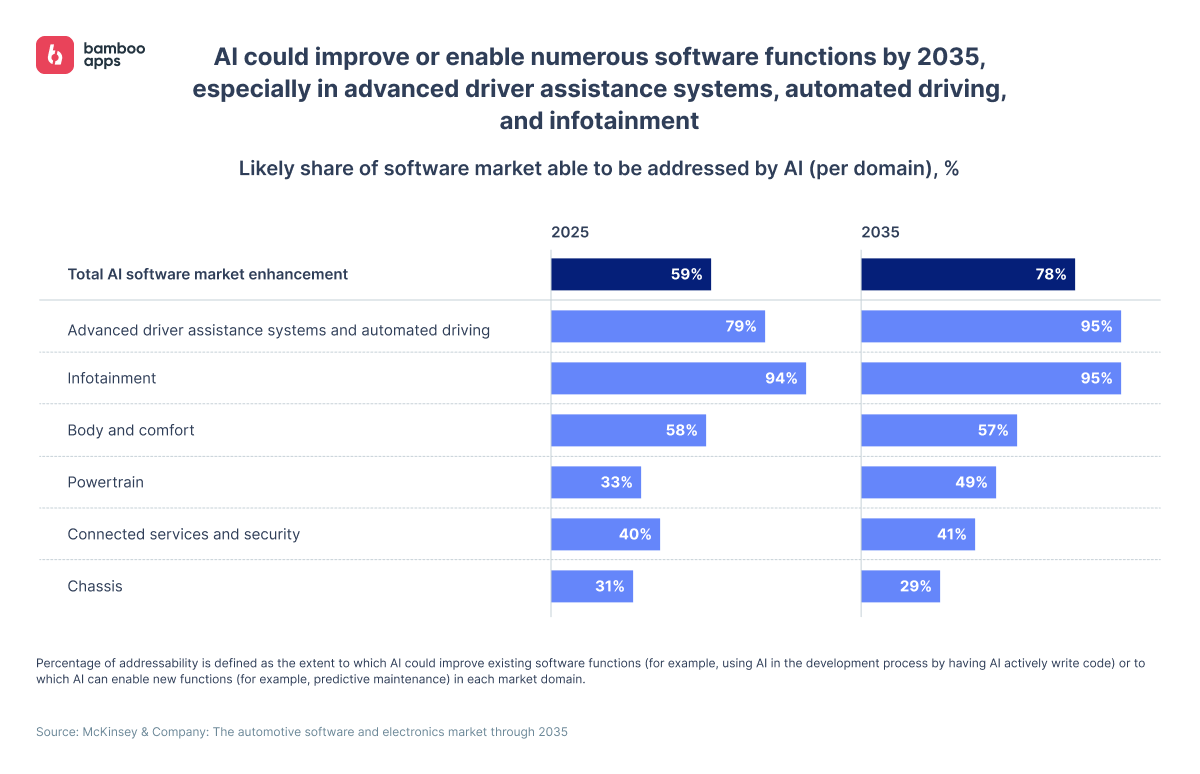

Industry trends highlight the stakes: AI could influence up to 70% of future software features in areas like ADAS, infotainment, and predictive services, while edge AI adoption grows to meet low-latency, safety-critical requirements.

As Rivian’s VP of Software Development, Wassym Bensaid, notes, vehicles today are “always on, always connected”, requiring “a very sophisticated level of integration throughout the entire hardware and software stack” to deliver the expected customer experience.

A partner capable of full-stack engineering can manage embedded, cloud, and AI layers together, anticipate cross-layer dependencies, and ensure that software is reliable, scalable, and production-ready, which is a clear signal of maturity for OEMs and Tier‑1s.

Bamboo Apps as a leading automotive software company

Based on the traits we’ve discussed, we believe that Bamboo Apps represents the type of partner that meets many of these criteria. Over the years, we have collaborated with OEMs and Tier‑1 suppliers across Europe, which we believe has given us insights into what helps automotive software projects succeed.

Building on that background, our teams work on connected car solutions, mobility platforms, and HMIs, which illustrate how we approach complex integrations while keeping the end-user experience in mind. Past projects with brands such as Jaguar Land Rover, Škoda, Mitsubishi Electric, and Rinspeed have allowed us to develop approaches that balance technical challenges, integration, and user-centric design.

To add to that, our team regularly participates in major events such as LEAP, MOVE, IAA Mobility and Transportation, Car.HMI, and GITEX, where we explore emerging trends in mobility and smart transportation.

Taken together, this track record shapes how we approach our automotive software services. If you are considering a partner for such initiatives, reach out to discuss your challenges and see how our experience might support your goals.

Looking for a reliable development partner for automotive software?

Get in touch to see how our production experience can support your team.